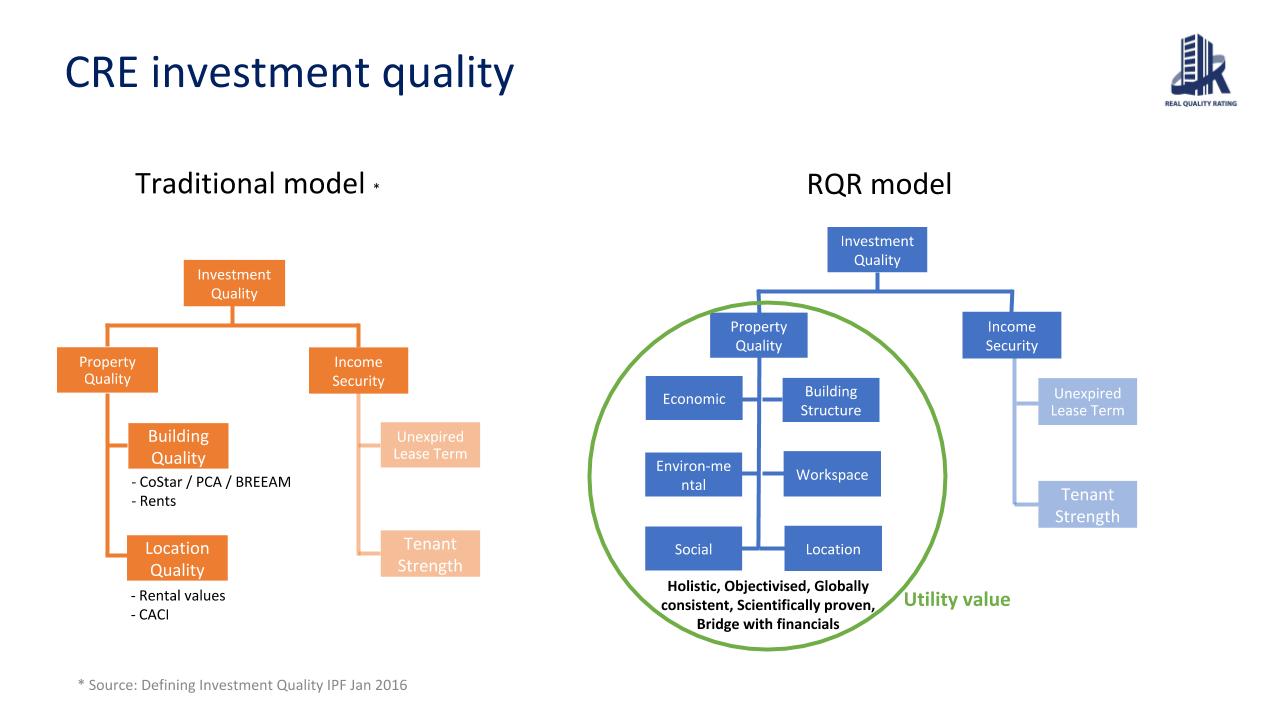

Beyond the commonly used terms of prime, secondary, and tertiary, a study commissioned by the IPF in 2016 proposes a definition of investment quality being property quality plus income security. It provides an attempt to define property quality as shown on the diagram but acknowledges several limitations due to the subjective weighting of quality factors, asset rating being time consuming and needing continuous updating, factors evolving over time, poor quality of information, financial indicators used as a measure of quality etc.

RQR has developed with the industry a measure of quality that resolves all these issues. It also addresses the inclusion of ESG factors in the measure of property quality and provides for a new risk management framework.

Keywords: #buildings #proptech #investments #realqualityrating